Presidential Election | What does it mean for the Stock Market?

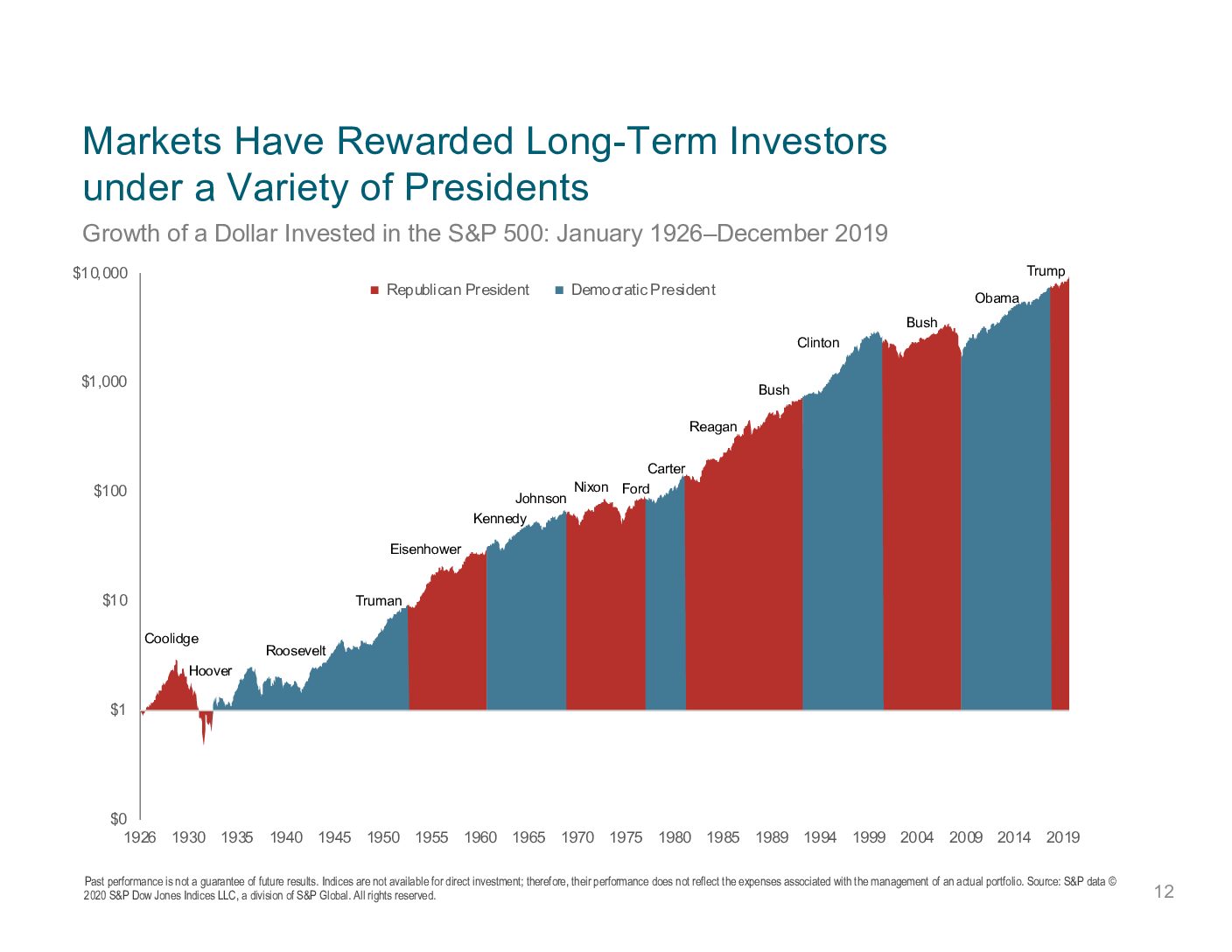

What do the upcoming elections mean for the stock market? A lot of my clients are asking me this question with the upcoming election between the two presidential candidates, Joe Biden and Donald Trump. This can be a loaded question for a financial adviser with clients on both sides of the political spectrum, republicans and democrats. We like to take the emotions out of investing and use time honored principles based on statistical evidence. We call it “evidenced based investing.” What I’m showing you in the chart bellow is the cumulative value of the stock market from 1926 under every president. The chart is shaded it red for Republican administrations, in blue for Democratic administrations. If we do a statistical correlation against this, we find there is no correlation. In other words, the market has historically grown and the economy has expanded in spite of who’s president.

Does the Stock Market go up under every President?

Statistically speaking there is no correlation between which party is in office and the continued expansion of the U.S. economy and the stock market. The stock market did go down under President Herbert Hoover. The stock market went up from the beginning to the end of Franklin Roosevelt’s 3 terms, though technically it went down during his second term. The stock market went down under the second term of George Bush Jr.’s second term because of the recession, caused by the subprime crisis. However, these are all the outliners. There is no overall correlation with which political party wins the white house!

What should you do with your portfolio during an election year?

Our firm uses an academic approach that believes objective based evidence and low-costs matter. We are one of a select group of fee-only advisers approved to work with Dimensional Fund Advisers. Dimensional Nobel Prize laureate advisers include Eugene Fama (University of Chicago), Robert Merton (MIT) and Myron Scholes (Stanford University). We believe in taking the emotions out of investing and use academic research that isolates the factors that tend to outperform the broad market over long time periods while understanding how to minimize risk characteristics of portfolio.

Given the knowledge that the presidential election has not historically changed the direction of the stock market, how can you profit from this? The answer is to have discipline in managing your portfolio and focus on the overall risk target of one’s portfolio and re-balance when you significantly deviate, regardless of any election noise. Past performance is no guarantee of future performance.