Hayward, CA – Benefits of Using Our Tax Record Shredding Services for Businesses

Posted in: Industry News

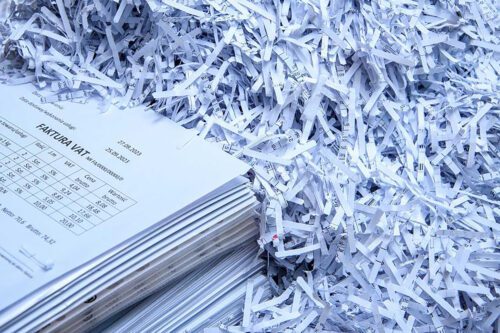

In today’s age of cyber threats and data breaches, businesses must take the proper measures to protect their sensitive information. This includes ensuring the proper destruction of tax records, which contain confidential information that can be exploited by identity thieves and other malicious actors.

In today’s age of cyber threats and data breaches, businesses must take the proper measures to protect their sensitive information. This includes ensuring the proper destruction of tax records, which contain confidential information that can be exploited by identity thieves and other malicious actors.

Why Companies Need Tax Record Shredding Services

Tax records contain sensitive information such as social security numbers, financial information, and other personal data that can be used for identity theft and fraud. Businesses that fail to dispose of these documents properly risk exposing their customers and employees to these threats. Additionally, companies that don’t follow the legal requirements for tax record retention and disposal can face severe fines and legal consequences.

Benefits of Professional Tax Record Shredding Services

Using a professional shredding service for tax record disposal offers numerous benefits for businesses. Here are a few of the most significant advantages:

- Enhanced Security: Professional shredding services follow strict protocols and use advanced technology to ensure the secure destruction of sensitive documents. This eliminates the risk of identity theft and fraud, giving businesses peace of mind.

- Regulatory Compliance: Professional shredding services are familiar with the legal requirements for tax record retention and disposal. Businesses can use their services to ensure they comply with all relevant laws and regulations.

- Cost Savings: Outsourcing tax record shredding can be more cost-effective than handling it in-house. Professional shredding services can handle large volumes of documents quickly and efficiently, saving businesses time and money.

- Environmentally Friendly: Professional shredding services typically recycle the shredded documents, reducing the environmental impact. This aligns with many companies’ sustainability goals and values.

How Often Should Businesses Destroy Tax Records?

The retention requirements for tax records vary depending on the record type and jurisdiction. Generally, businesses should retain tax records for at least three years and sometimes up to seven years. However, consulting with a professional is essential to ensure compliance with all relevant regulations.

Once the retention period has passed, businesses should dispose of tax records promptly. This ensures that the documents don’t pile up and become vulnerable to theft or damage. Professional shredding services can help businesses establish a schedule for regular disposal of tax records, reducing the risk of non-compliance and security breaches.

Tax Record Shredding Process

- Collection: Professional shredding services will collect the documents from the business’s location, ensuring secure transportation.

- Shredding: The documents are shredded using high-tech equipment that ensures the destruction of the paper.

- Recycling: The shredded paper is typically recycled, reducing environmental impact.

- Certification: The shredding company will provide a certificate of destruction, which documents that the documents were disposed of properly.

Jessica’s Shredding Team gives businesses the peace of mind that their tax records are properly disposed of. Contact us today to learn more about our tax record shredding services and how we can help your business stay secure and compliant.

Return to: Hayward, CA – Benefits of Using Our Tax Record Shredding Services for Businesses

Social Web