Orlando, Florida – Property Damage and FAQ | Florida Property Damage News

Posted in: Videos

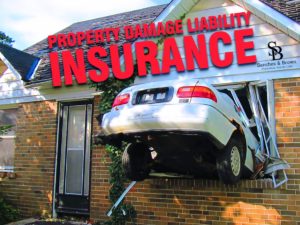

Property Damage and FAQ

When you are in a vehicle accident, pain is not the only consequence. Oftentimes, the property damage to your vehicle ends up becoming the greatest inconvenience of all. You may be wondering: Who is going to pay for my repairs? Will I have to pay for anything? What happens if my vehicle is damaged beyond repair? All are legitimate questions. Here are a few of the frequently asked questions when it comes to Property Damage:

1. Whose Policy Pays In a Property Damage Claim?

1. Whose Policy Pays In a Property Damage Claim?

Even though the State of Florida is a no-fault state, the tortfeasor’s (person that caused the accident) insurance policy pays to repair the property damage. In Property Damage situations, the owner of the vehicle that caused the accident is responsible for the repairs, not the driver, e.g., Daniel borrows his brother’s vehicle to pick up some supplies. While backing out of his parking spot at the office supply store, he hits a parked vehicle. Daniel’s brother’s insurance policy will cover the damages to the parked vehicle even though Daniel was the person that was driving.

2. What’s covered?

2. What’s covered?

While Property Damage Liability does not cover the damages to your own vehicle, it does help pay for damages to someone else’s vehicle or other property damage that was caused by you, up to the policy’s limits. In most cases, Property Damage Liability will usually also cover damages you caused to other objects besides a vehicle, e.g., telephone pole, a fence, lamp posts, a house, or a guardrail.*

3. How Long Will It Take to Process a Claim?

3. How Long Will It Take to Process a Claim?

Unlike the injury portion of an accident, Property damage claims do require additional time and cooperation from all parties involved for there to be a resolution. The reason for this is because fault needs to be determined and generally, all parties involved need to give a statement to the claims adjuster/representative. Communication is usually the most important factor when it comes to getting your vehicle repaired and having those repairs paid for quickly. E.g., Daniel contacted his friend, Carlos, to notify him that he accidentally backed into his vehicle while at the office supply store. Daniel’s brother later files a claim with his own auto insurance company. The claims representative contacted both Daniel and Carlos to verify the accident. If no liability dispute arises, a check for the repairs will then be mailed to Carlos after a reasonable time.**

4. What are the state requirements for Property Damage in Florida?

4. What are the state requirements for Property Damage in Florida?

Per the exact Florida Statute language, “Every owner or operator of a motor vehicle required to be registered in this state shall establish and maintain the ability to respond in damages for liability on account of accidents arising out of the use of the motor vehicle in the amount of $10,000 because of damage to, or destruction of, property of others in any one crash.” In other words, $10,000 is the state minimum. ***

5. What if the person that hit me doesn’t have or carry Property Damage?

5. What if the person that hit me doesn’t have or carry Property Damage?

If you are hit by someone that does not have the State Required Minimum Property Damage Liability of $10,000, you might still be able to get your damages repaired. There are generally two ways: One possibility is to legally pursue the person who hit you for the damages in court. But, given the fact that they don’t carry Property Damage Liability, the odds of collecting on such a person are minimal. The other possibility is checking your own insurance policy to see if it carries Collision Coverage.

6. Would Collision Coverage help me?

6. Would Collision Coverage help me?

Collision insurance covers some or all of your vehicle repair or replacement costs if you are in an accident with another vehicle or you drive into an object. This kind of coverage may not be required by Florida, but in my experience, it is an essential part of any responsible auto policy.

****The information contained on this website is not to be construed as legal advice. It is not intended to solicit or form an attorney-client relationship.

About Us

We are passionate about representing the everyday-person who has been hurt by another’s negligence. We hold insurance companies accountable and strive for the best possible results for each client. Always Your Legal Voice Fighting By Your Side – Sanchez and Brown!

Please call us for a free consultation, we’d love to hear from you. Our Contact Information:

Tel: (407) 515-1125 Website: www.sanchezbrown.com

* We recommend that you consult with your insurance company to get the full details as it may vary from company to company.

** Please note that this is a best-case scenario. Settlement times vary and depend on the cooperation from all parties involved.

*** http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&URL=0300-0399/0324/Sections/0324.022.html

Return to: Orlando, Florida – Property Damage and FAQ | Florida Property Damage News

Social Web