While the government has initiated various schemes to help boost home ownership, the reality is that federal tax benefits are actually only helping the affluent buy bigger and better houses through easy loans. Findings of a recent study support this, showing that the tax deductions related to mortgage interest have contributed as much as 18% to augmenting home size in the most affluent regions of the nation.

While the government has initiated various schemes to help boost home ownership, the reality is that federal tax benefits are actually only helping the affluent buy bigger and better houses through easy loans. Findings of a recent study support this, showing that the tax deductions related to mortgage interest have contributed as much as 18% to augmenting home size in the most affluent regions of the nation.

The study, conducted by economists at R Street Institute and published in March 2014, analyzed IRS data on a zip code basis to assess the distribution of tax benefits across the major metropolitan regions as well as income levels. The findings of this study only serve to affirm economic research that points towards tax preferences not really benefiting Americans, although they lead to forgone revenues of about $175 billion each year for the government.

President Barack Obama has proposed curbing tax benefits related to mortgage interests on several occasions, especially for people who earn more than $200,000 annually or married couple who earn more than $250,000 annually. Recently, Dave Camp, the House Budget Chairman, has also proposed a cap on mortgage interest deductions associated with new loans at a principal of $500,000, from the current limit of $1 million. However, policy makers are reluctant to curb such deductions, mostly because they are popular with their voters and support the real estate industry.

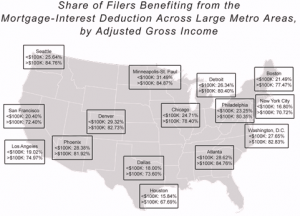

The study also shows that tax deductions for owner-occupied homes end up benefiting very few households, with homeowners who earned more than $100,000 a year were three-to-four times more likely to claim the deduction than those who earned less than $100,000. The tax benefit is available only if one includes itemized deductions on tax returns. The reason than many prefer not to itemize deductions is that they are likely to be liable to paying lower taxes using the standard deduction.

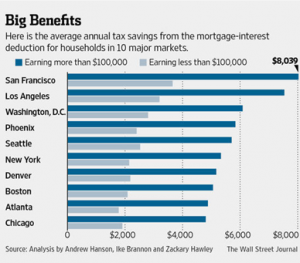

The research also shows that the tax benefits differ significantly by region and income. The findings show that while the annual savings for households that claim the housing deduction average at $12,300 in San Francisco, savings are as low as $2,900 in Dallas. On the other hand, those earning more than $100,000 annually end up saving $8,000 a year through the mortgage interest deduction in San Francisco, while those earning less than $100,000 are able to save $3,700.

Lastly, the study demonstrates that suburban households are twice as likely to benefit from the deduction as urban households.